nassau county property tax rate

The appraisal of property is performed by the Property Appraiser who is responsible for determining the value of property including exemptions. - a full value FV municipal tax rate by dividing the total municipal levy general town and highway levy plus fire protection and other dependent special district levies by the total full taxable value for municipal purposes per 1000 full valuation.

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Nassau County property tax rate is one of the highest in New York state but if you are 65 or older you may be eligible for a Nassau County senior citizen property exemption.

. The Nassau County Department of Assessment determines a tentative assessment for every property as of January 3 2022. Nassau County lies just east of New York City on Long Island. Tax rates in each county are based on combination of levies for county city town village school district and certain special district purposes.

The Property Appraisers office determines the assessed value and exemptions on the tax roll. The NYS Office of the State ComptrollerOSC calculates. The median property tax in Virginia is 186200 per year for a home worth the median value of 25260000.

Even so the average effective property tax rate in Suffolk County is 237 far above both state and national averages. The Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in Nassau County. Nassau County Senior Citizen Property ExemptionA Complete Guide.

If the taxable value of a property is 75000 and the taxing authoritys millage rate is 72 mills then the taxes due would be calculated as follows. Virginia is ranked number twenty one out of the fifty states in order of the average amount of property taxes collected. For New York City tax rates reflect levies for general city and school district purposes.

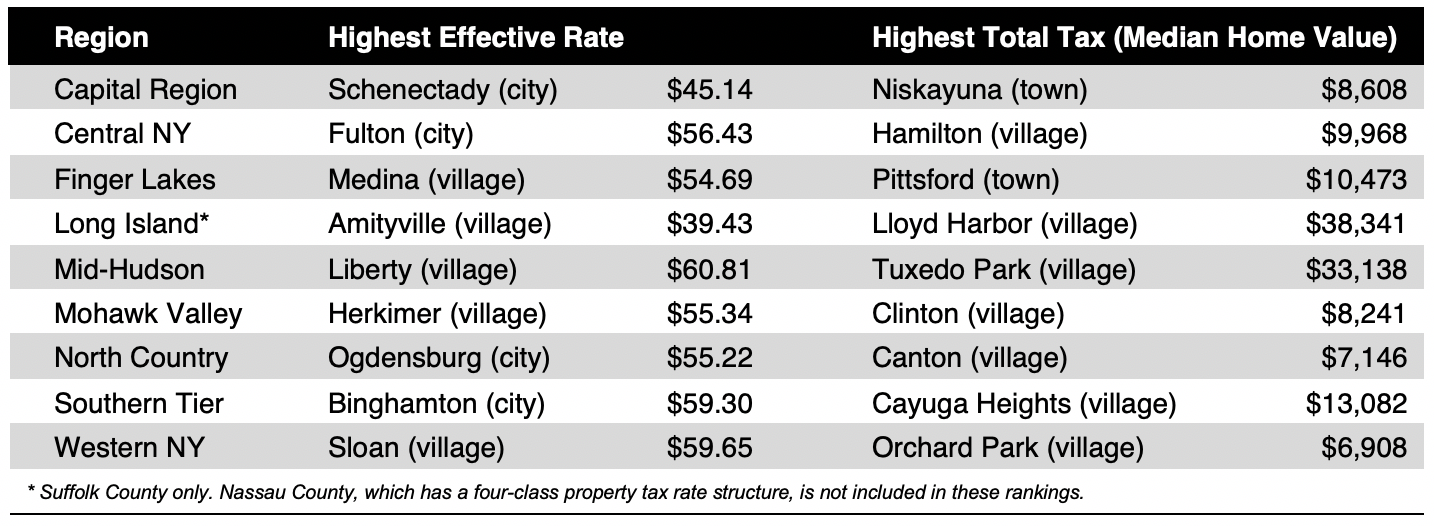

Counties in Virginia collect an average of 074 of a propertys assesed fair market value as property tax per year. Floridas average real property tax rate is 098 which is slightly lower than the US. New York City and Nassau County have a 4-class property tax system.

Choose a tax districtcity from the drop-down box selections include the taxing district number the name of the districtcity and the millage rate used for calculation. Also New York State School Tax Relief Program provides homeowners who earn less than 500000 and own and live in their. - a full value FV county tax rate by dividing the county tax levy county.

In 2018 the average millage rate in the county was 264 mills which would mean annual taxes of 7920 on a 300000 home. This guide will help you understand the purpose of property tax exemptions and show you how to lower property taxes with the help of. If you need to discuss these amounts contact the Property Appraisers office or visit their website Nassau County Property Appraiser.

The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties. The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county sales tax and a 038 special district sales tax used to fund. If you believe the assessment is inaccurate you may appeal by filing an application for correction with the Assessment Review Commission by March 1 2022.

Rockland County offers several exemptions that qualified homeowners can apply for such as Veterans Senior Citizen Cold War Veterans Volunteer Firefighters and Ambulance Workers Limited Income Disability or Home Improvement exemptions.

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

New York Property Tax Calculator 2020 Empire Center For Public Policy

Springfield Il Statue Of Abraham Lincoln Civil War Monuments Historical Events University Of Illinois Springfield

Nassau County S Property Tax Game The Winners And Losers

Please Join Us At The Storm Recovery Resource Fair On Wednesday February 26th At The Lindell School In Longbeach Ny Nyrisi Nassau County Long Beach Storm

Destinations For Fleeing New Yorkers The Big Picture Big Picture Nassau County Vacation Property

Property Taxes In Nassau County Suffolk County